In case you haven’t heard, financial markets are plummeting again. We have yet to see how this will play out, but it was to be expected because absolutely nothing has been resolved since the last time. The most direct causes–not to be confused with the most fundamental ones–are trouble with the banking system in Europe and trouble with the banking system in the US. In the media, the former is discussed in terms of countries for perverse reasons and both are further abstracted and described in terms of attitudes held by “the markets” towards everything from employment data to Ben Bernanke’s body language. I call it financial anthropomorphism and this is a beautiful example.

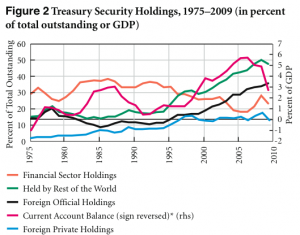

Insofar as economies produce and consume things, the US and most other “advanced” countries have been basically stagnant since 2008. The “recovery” was confined to financial markets that have been more or less doing their own thing with a lot more assistance from the federal government than anyone else has gotten. If you look back, narratives switching between a “double-dip recession” and “green shoots” probably reflect whatever was going on with financial markets at the time rather than real output or employment.

Recessions are technically defined by the NBER dating committee and according to them, the last one began in December 2007 and ended in June 2009. The dating committee bases its definition largely on changes in trends relating to (reported) aggregate income and expenditures, particularly expenditures (GDP). Note that expenditures can be on anything, so even something like hikes in health insurance premiums count towards GDP growth (check the national accounts for yourself). As far as most people are concerned, national income has actually been falling:

Employees have always received more than half the total national income, until now. In 2010, the percentage of national income devoted to wages and salaries fell to 49.9 percent, and it slipped a little more to 49.6 percent in the first quarter of this year. That continued decline may help explain the economic worries of many Americans who have jobs but still fear they are falling behind.

The idea of a “double-dip recession” starting now is basically just a media narrative because nothing has improved at all for most people. The unemployment and underemployment statistics don’t mean much of anything anymore because so many people have completely fallen off the radar and become unpeople as far as decision-makers are concerned. It’s worth noting that the system for measuring national income that we currently have came into existence during the Great Depression.

Financial markets coming down to the economic reality in which everyone else exists might finally draw the attention of officialdom. The course we’ve been on for the past few years isn’t going to improve unless some serious changes are made to how we do things.