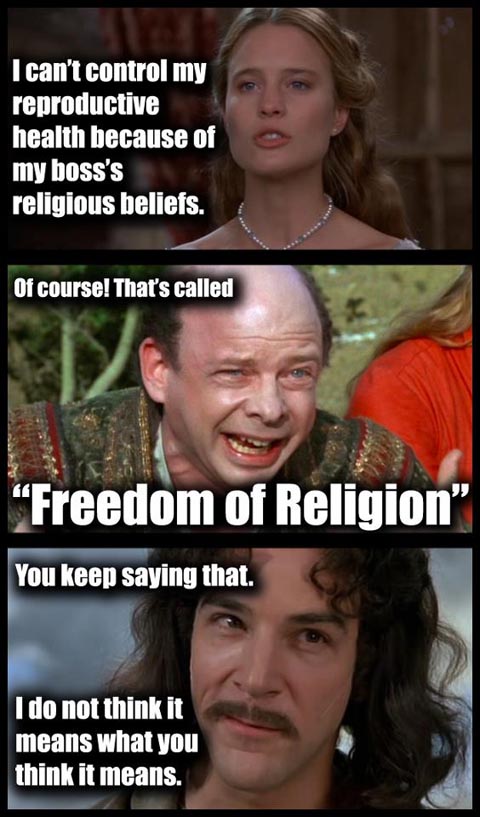

- If you remember the Susan G Komen dumping Planned Parenthood debacle, don’t think that’s the end, because the Republicans have gone full speed crazy into the War on Contraception as part of their War on Women and War on the Poor.

- The Virginia House of Delegates just passed a bill requiring a vaginal ultrasound before you get an abortion.

- A Sioux City Iowa Bishop demands violent opposition to birth control

- Awesome Virginia State Senator Janet Howell struck back with a joke amendment demanding men get rectal exams for ED medicine. It did not make the final bill.

- Not to be outdone, now the Virginia House of Delegates passed a “zygote is a person” law! It is unknown if under this bill you can deduct used tampons as dependents on your taxes

- And here is Ron Paul ranting about “honest rape.”

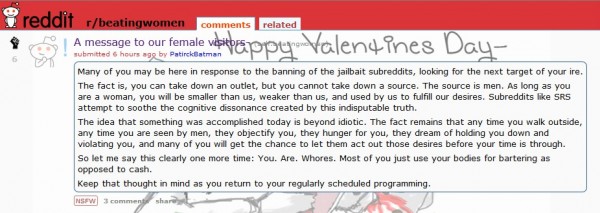

- Reddit reluctantly agreed to take down boards containing child porn after being shamed by the goons at SomethingAwful. But don’t worry, this was waiting at Reddit:

- If you remember this super-racist commercial from Michigan senate candidate Peter Hoekstra –

Then you will be happy to know it has killed his poll numbers. - Romney got googlebombed!

- The TSA is using body scanners to peep on hot chicks

- Certified Nutjob Bill Turner has scribed a pretty kickin’ Super Obama Conspiracy rant

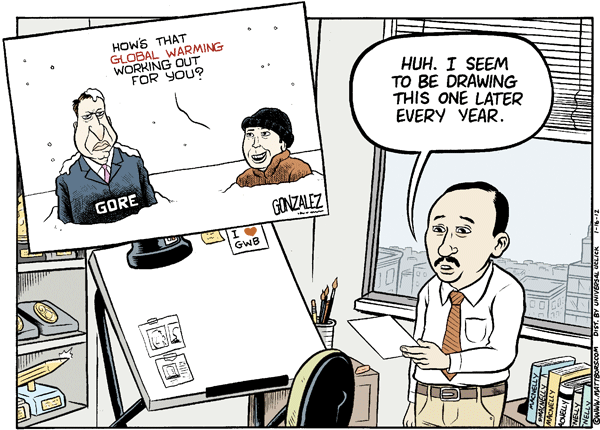

- Cartoon of the Day:

Category Archives: #snakeoil

Through the economist’s looking glass

I’ve had people requesting me to post more economics-type stuff for a while now and I think it’s time to get to work on it. I’ve had trouble thinking of exactly what would fall under that category as I would define it, but I keep getting more requests, implying I have a definition. The easiest way out of this is to start by taking a look at what we don’t want.

We’ll start with this piece where Brad DeLong contemplates whether or not he and his peers “understand what was going on.”

Here is the most interesting part of [Larry] Summers’ long answer: “There is a lot in [Walter] Bagehot that is about the crisis we just went through. There is more in [Hyman] Minsky, and perhaps more still in [Charles] Kindleberger.” That may sound obscure to a non-economist, but it was a devastating indictment….Asked to name where to turn to understand what was going on in 2008, Summers cited three dead men, a book written 33 years ago, and another written the century before last.

The first problem is asking that question of one of the people most responsible for the present mess and a number of others over the past few decades. Putting that aside for a moment, DeLong gave a strange introduction to one of the three:

Minsky (1919-1996) is best approached not through his collected essays, entitled Can “It” Happen Again?, but rather through the use Kindleberger (1910-2003) made of his work in his 1978 book Manias, Panics, and Crashes: A History of Financial Crises.

Having read some of Minsky’s work, this caught my attention. I get the sense that he doesn’t want the “non-economist” to get the wrong impression. He goes out of his way to avoid mentioning Minsky’s other works and steers us around the one he will name. Here’s a clue as to why he keeps his distance from Minsky’s Stabilizing an Unstable Economy (don’t worry too much about the technical terms):

The Walrasian input to the neoclassical synthesis starts with a discussion of an abstract exchange (barter) economy: the analogue may be a village fair. Results are obtained by analyzing a model that does not allow for capital-intensive production, capital assets as we know them, and capitalist finance. Using an artificial construction of trading relations, the theory demonstrates that a decentralized market economy achieves a coherent result.

Standard economic theory then goes on to show that the property of coherence also carries through for an economy that produces, but only under heroic assumptions about the nature of capital and time….The theory is set up in such a way that any deviation from the labor supply-labor demand equality will be removed by market interactions; that is, the theory holds that full employment is achieved by means of the internal operations of the economy. The theory does not explain, however, how any initial deviation is brought about: unemployment as the result of economic processes is unexplained.

The neoclassical synthesis (mainly the work of Paul Samuelson) has been the foundation of standard economic theory for over fifty years. It has been modified in various ways, but has retained this same theoretical core. The degree to which it has remained unchanged is striking, as we can see by looking at what Brad DeLong is teaching his students:

We neoclassical economists really do believe that markets are extraordinarily flexible, powerful, and adaptive social institutions. We believe that they recover from shocks. We believe that if something goes wrong with the market system and it finds itself out of equilibrium with substantial excess demands or excess supplies, that it will right itself and crawl its way back to supply-demand equilibrium quickly.

It might not fix itself as quickly as we would wish. We might well want to have the helping hand of the government pushing it back to equilibrium. But the idea is that a period of high unemployment with lots of people who want jobs and could do jobs and do not have jobs not fixing itself–that a period of fifteen months after the downturn ends with no sign of any return toward equilibrium in the labor market–that is very distressing for us neoclassical economists.

No wonder he advised looking elsewhere to “understand” what is wrong with standard economic theory. But I shouldn’t single DeLong out, Paul Krugman has also vigorously (if dishonestly) defended the same thing. Shifting from the media and classrooms to policy advisers, Christina Romer was ahead of the game in obsessing about balanced budgets for their own sake as she celebrated the “great moderation” (an equilibrium concept) right before the crisis hit. Returning to Larry Summers, he was once quoted as saying, “Spread the truth–the laws of economics are like the laws of engineering. One set of laws works everywhere.” He has spent plenty of time in positions of power engineering his surroundings to fit this view. I could go on (and probably will in the future) but it should be clear that this will not do.

There are many alternatives, but some work is inevitably involved if we’re going to get rid of this destructive ideology. L. Randall Wray (one of Minsky’s PhD students) is going to be giving free online classes on his university department’s blog starting soon. You could do worse than following those and David Harvey’s lectures on Marx’s Capital (also free online). The former will cover a number of issues that are currently coming up in the media like government deficits and the financial system and the latter will help you sit back and appreciate a much broader perspective than the term “economics” tends to imply. That should get anyone off to a good start without even having to buy a textbook. Where to go from there should come to you pretty naturally.

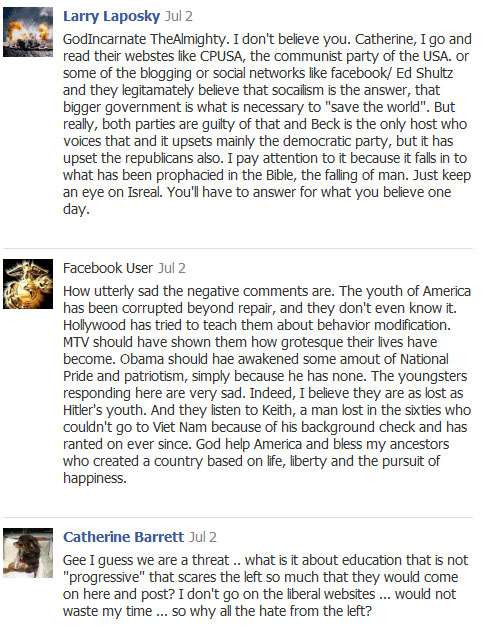

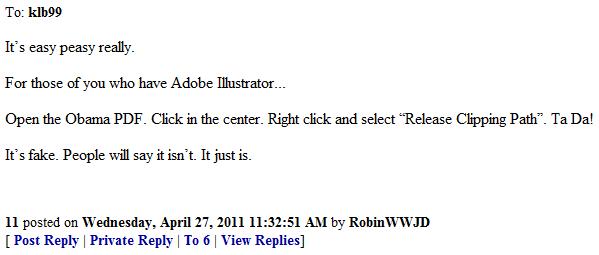

Obama releases Birth Certificate, Wingnuts unimpressed

Obama surrendered to the right once again and released his long-form birth certificate to try to quiet the insane birthers. Because Obama underestimates the insane racism of his opponents, this release matters 0.0000%, as no one ever will be convinced if they think he’s a foreign born Muslim commie Kenyan alien robot. Dissenters fall into two camps, one that is convinced this one is fake and is going to insane lengths to prove it, and the one that doesn’t care because they’re following an incorrect definition of “Natural born citizen.” Though this does make the Republicans look even more loony, so maybe this was a shrewd move.

A sample response:

Also, this has prompted death threats from at least one poster on PatriotActionNetwork.com (formerly Resistnet.com):

Despite their name change, we can always expect quality death threats against the president from Resistnet— I mean, PatriotActionNetwork!

more reactions below the fold.

Continue reading

I got your rating right here, pal!

The same group that turned mortgage-backed securities from Grade F failures to Grade A eventual economy destroyers is now downgrading US debt.

Now, I realize all this economic stuff can all blur together in a stream of boring languages, but this is a good example to show off how much of a joke the whole thing is. There are three groups that rate credit in this country: Standard & Poor’s (S&P), Moody’s Investor Service, and Fitch Ratings. They are pretty much all scummy, for reason which we won’t get into right now. S&P is the one we’re looking at today.

The S&P lowered its outlook on U.S. debt.

S&P changed its outlook on the United States from “stable” to “negative” and said the federal government could lose its AAA rating if officials fail to bring spending in line with revenues.

Keep in mind it didn’t change the rating, it just warned things might change.

Notable douchebag Eric Cantor is trying to use this as an excuse to hold the debt ceiling vote hostage so he can get a gold plated douchebag holder or whatever it is he wants. but, as Eric Cantor is a Republican, he’s functionally moronic and the news story he sent out mentions the last time the S&P downgraded their outlook on US debt was 1996…out of fear that the GOP would block a debt ceiling vote! Someone break out the iron…

Krugman says this is no big deal

Barry Ritholtz says the S&P are a bunch of wankers

To which I say “Who Cares?”

Its not that I disagree with their assessment — I do not — but I pay it little heed. It was much more important to me as an investor that PIMCO’s Bill Gross was out of Treasuries a month ago (and indeed, is short) than what S&P says. That was all any bond investor needed to know — no ratings agency necessary.

If ever there was an organization more corrupt, incompetent, and less capable of issuing an intelligent analysis on debt than S&P, I am unaware of them. Why do I write this? A huge part of the reason the US is in its awful financial position is due to the fine work of S&P.

Consider what Nobel Laurelate Joseph Stiglitz, economics professor at Columbia University in New York observed:

“I view the ratings agencies as one of the key culprits. They were the party that performed that alchemy that converted the securities from F-rated to A-rated. The banks could not have done what they did without the complicity of the ratings agencies.”

Hence, the “negative outlook” of US debt has come about because the inability of Standard & Poor’s to have performed their jobs rating mortgage backed securities. Ultimately, this enabled the entire crisis, financial collapse, enormous budget deficit and now political over the debt ceiling.

Of course there is a negative future outlook. Its in large part the work product of S&P and Moody’s.

Why we even have Nationally Recognized Statistical Rating Organization (NRSRO) any longer following their payola =driven corruption, their gross incompetency and their inability to discharge their basic duties is beyond my understanding.

Even with new laws, the ratings agencies escape any form or regulation or persecution for their crimes, past and future:

When Dodd-Frank became law last July, it required that ratings agencies assigning grades to asset-backed securities be subject to expert liability from that moment on. This opened the agencies to lawsuits from investors, a policing mechanism that law firms and accountants have contended with for years. The agencies responded by refusing to allow their ratings to be disclosed in asset-backed securities deals. As a result, the market for these instruments froze on July 22.

The S.E.C. quickly issued a “no action” letter, indicating that it would not bring enforcement actions against issuers that did not disclose ratings in prospectuses. This removed the expert-liability threat for the ratings agencies, and the market began operating again.

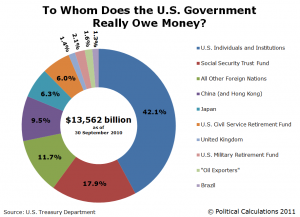

As for the debt ceiling, ever wonder just who we owe this debt to? Ourselves, mostly:

Any talk you hear of China owning the US is just xenophobic scaremongering.

Who are these Teabagger candidates, anyway? – Rick Scott Edition

Rick Scott should be a familiar enough name to anyone whose lived through the Healthcare Reform battle of last year. As the founder and former CEO of healthcare giant Columbia/HCA Rick Scott held a commanding post over the lucrative cashcow that is the Healtcare industry. Corrupt wouldn’t even begin to describe the way in which Rick Scott operated his mega-corporation, a company who as the largest healthcare provider in the country was tasked with providing quality medical care and resources for the sick and injured. A company that Rick Scott publicly stated he wanted to run with the penny pinching bottom-line efficiency of a Wal-Mart, hoping one day Columbia/HCA could be “the McDonalds of the Healthcare industry”.

Under Rick Scott’s guiding hand Columbia/HCA began to bilk the federal government out of hundreds of millions of Medicare dollars, falsifying documents, scamming their own sick customers just so Rick could make a few extra million dollars for himself. When the 1994 Healthcare debate began Rick Scott and his company heralded the single most successful campaign to defeat then President Clinton’s efforts to provide coverage and care for the neediest patients in the country. You’d think a Healthcare company would be a little more compassionate about helping their own customers. Scott’s swindling scam continued until 1997 when the government began to get wise to the rampant corruption and abuse of the Medicare system and took action against Columbia/HCA to the tune of $1.7 BILLION dollars. The Columbia/HCA settlement still stands as the single biggest fraud settlement in the history of the United States. It also cost Rick Scott his job as CEO (a narrow margin of 1 vote from HCA’s board decided Scott’s fate).

As a disgraced fraudster who some how avoided jail time for his misdeeds (scamming the government out of money for the sick and elderly) Rick Scott soon found himself working in venture capital (again in the healthcare industry). With his new found funds and the country’s renewed interest in reforming the Healthcare system, this time with a campaign led by President Obama, Rick Scott again began to mobilize his wealth in order to fight “socialized medicine” and “Obamacare”. With his own millions, Rick Scott created the astroturf organization “Conservatives for Patient’s Rights” which was, again, one of the if not the most vocal money-fueled opponent of the Obama Healthcare Reform plan (Dick Armey’s Tea Party was a close second).

After all, if Healthcare Reform did pass this time Rick Scott would stand to lose money in his own awful business interests, like Solantic LLC, a walk-in clinic that charges patients like a fast-food chain would (pricing options fall under “small, medium, or large” scale) or the failed TV venture he went in on with a former Columbia/HCA executive called America’s Health Network that broadcasts medical and wellness programming. It shuttered in 2001, but not before Columbia/HCA made a bid to buy the network from their former CEO. Then it turns out Columbia/HCA couldn’t afford the deal and declined the investment, and then they laid off 80% of their work force because they were so horrible and out of cash (due to the $1.7 BILLION DOLLARS they were paying back to the federal government).

Oh and he also invested in the Texas Rangers baseball team with George W. Bush back in the 1990s. I’ll let that speak for itself.

And now, Rick Scott is taking his money bags (from Stamford, Conn) to higher ambitions. Rick Scott is officially running for governor of every Healthcare mogul’s favorite place to do business, Florida. It’s no wonder Rick Scott chose to run in Florida actually. As we all know, Florida houses one of the biggest populations of the elderly and aging in the country, a demographic that truly is in need of the latest in healthcare advances. Florida is also known for its lucrative and shady pain clinics, a system set up much like California’s medical marijuana dispensaries except that instead of selling a harmless plant they deal in expensive and highly-potent narcotics (that earn more for the Pharmaceutical companies than any MMJ clinic could ever dream of). Florida would be the perfect place for a multi-millionaire healthcare executive to shack up as governor for a few years, possibly “reforming” their medical system so much that it would allow Rick Scott’s own healthcare business interests to suck up even more money from the poor and disadvantaged.

Richard L. Scott Investments LLC is based out of Florida after all. Like our own millionaire gubernatorial candidate Meg Whitman, Rick Scott has spent about $60 million dollars of his own money to fund his campaign. It would seem as though Rick Scott has an incredibly vested interest in running the same state where his healthcare companies are based. A state that sees some of the biggest expenditures on healthcare costs in the country. The only state in the nation where you can find Rick Scott’s Solantic McClinics, the only for-profit clinic in the United States that carries pharmaceuticals from Pharmaca Integrative Pharmacy, Inc., another Rick Scott investment that pushes generic drugs to customers sold at prices well below that of the competition. A strategic business relationship and money making scheme, not unlike the rampant corruption found at Columbia/HCA during Scott’s days, that has former doctors alleging that Solantic pushed them to prescribe unnecessary medications through the Pharmaca brand and required them to run unnecessary tests and procedures on patients who enter Solantic clinics with nothing more than common colds.

And this man, Rick Scott, will quite possibly win the gubernatorial election in Florida. A man whose is banking his campaign and his campaign’s advertising blitz on Scott’s reputation and record as a sterling business man. As a candidate and former corporate scammer who says he wants to “run Flordia like a business” it remains to be seen just how far into the ditch Rick Scott can drive things before getting voted out by the board of directors and walking away with a $310 million dollar severance package.

The economics crisis

In a country with almost 15 million people out of work, it is amazing that any economists still have jobs. This one is their fault first and foremost. Economists are supposed to know about the economy and provide advice on how to avoid disasters before they happen and help us recover from the bad things happen in spite of good advice.

The economics profession has not done well on this simple scorecard. Remarkably, rather than improve their game, economists are now busy dampening down expectations so that the public will not hold them responsible for the state of the economy.

….

Having failed to prevent disaster, economists are now anxious to tell us that there is nothing that they can do to remedy the situation. The story they are pushing is that unemployment is structural, not cyclical – a refrain now echoed by op-ed columnists. This means that people are not unemployed because of a lack of demand in the economy, but rather they are unemployed because there is a mismatch between the available jobs and the skills and location of the available workers.

….

In short, there really is no evidence for a problem of structural unemployment. The problem is that because of bad policy, we don’t have enough demand in the economy. If there is any mismatch of jobs and skills, it is between economists’ positions and the people who fill them.

First off, don’t defer your judgment to someone because they’re “an economist” and sound like they know something. That said, Dean Baker is an economist who has managed to publish a number of books, help draft legislation, and appear on the almighty television on a pretty regular basis despite his tendency to veer from the party line. In the article quoted above, he links a study done by the Federal Reserve that concluded that economists could not have been expected predict the current financial crisis, citing him as one of the people who did predict it:

One of the first prominent housing pessimists was Dean Baker of the Center for Economic and Policy Research in Washington, who in 2002 wrote that:

“In the absence of any other credible theory, the only plausible explanation for the sudden surge in home prices is the existence of a housing bubble. This means that a major factor driving housing sales is the expectation that housing prices will be higher in the future. While this process can sustain rising prices for a period of time, it must eventually come to an end. (Baker 2002, p. 116).

However Dean Baker and the others that made surprisingly accurate predictions were actually wrong because:

The “Fundamental Theorem of Asset Pricing” implies that the evolution of asset prices is, to a first approximation, unpredictable.

That’s pretty offensive, but it gets even better in a footnote:

[E]conomists both inside and outside academia may have been reticent to make any sort of predictions, for fear of damaging their reputations if they were wrong.

However if they neglected to do so and there was a massive financial crisis, their reputations are just great and they shouldn’t shy away from making policy recommendations that will affect the livelihood of millions. I’m not sure if it’s outright contempt for people, extreme insularity or both, but this is pretty clearly a problem. They’ve divided themselves into camps on how to view the unemployment problem, which pushes policy predictions into the future so they can avoid a little embarrassment despite the predictable consequences on the most vulnerable. It’s very telling that both camps have a point and bad policy could come out of either view though it’s absolutely certain for the ones that believe that the only solution to a “structural problem” is just sort of creating unpeople who are just going to have to use the income they don’t have to buy some bootstraps.

You can’t spell “you” without ‘Glenn Beck U’!

Hey you on the couch! Yes, you.

Are you tired of entitled arrogant “educated” people like your boss or scientists always telling you what to do or saying how Global Warming isn’t a lie? Frustrated by the fact that the only thing setting you and “Mr. Know-It-All” apart might simply be a college degree or high school diploma? Attending a traditional education institution can take a lot of work and time, sometimes as much as 4 or even 5 years, possibly requiring a commute or even the need to read books, but thanks to the wonders of technology now YOU can enjoy the quality of a university education right in the comfort of your own home!

Announcing the groundbreaking of the nation’s newest institution of American academic thought and achievement, Beck University! Started by one of America’s most eminent educator, thinkers, and morning talk-radio hosts, Glenn Beck invites you and other patriotic like-minded Americans to submit a student application today and begin your journey into the world of a college education. By studying to get your degree at Beck University you will be joining the ranks of other college educated smarty smarts such as Ann Coulter, Former President Ronald Reagan, and Legendary football coach and occasional guest on Sean Hannity’s ‘Great American Panel’, Tony Dungy.

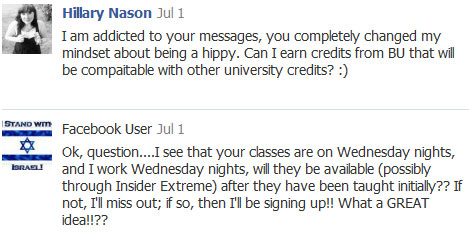

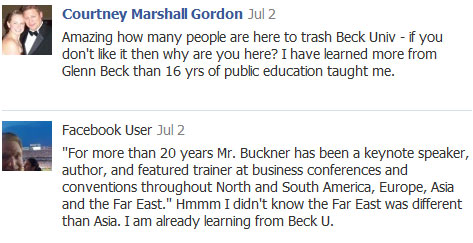

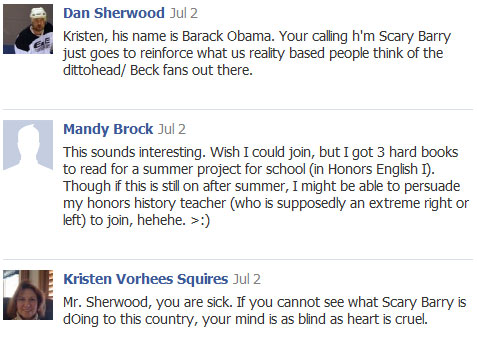

Beck University is accredited by the New England Educational Board of Non-Accredited Schools and is the only college education that’s available on a subscription basis (as part of the “Extra Features” section on Glenn Beck’s ‘Insider Extreme’, available exclusively at GlennBeck.com. Just read some of the Facebook Comments our eager students have left us inquiring about our fine institution and thanking us for establishing a mecca of educated thought like Beck University:

Some generous souls just wanted to thank Glenn for his service to the truthseekers of the world:

And some just wanted to hate on the snotty “college degree holders” who commented on how Beck University is completely and utterly ridiculous, an institution with no connection to reality whatsoever that the very thought of its existence is laughable and depressing:

And this was just the first 300 responses!

Yours Truly,

skiplogic

Beck University, Class of 2011

Charity Studies, Minor in Hope

Glenn Beck ‘GoldGate’ gaining gratuitious gravity

Investing your hard earned money in pure gold nugget with a company like GoldLine, safe, reliable, a decision worthy of prayer. Because of gold’s historic perceived value, the metal of choice for ballin’ players through out history from the ancient Aztecs to Henry VIII and now Chamillionaire, having your money staked in owning a lot of the physical element gold, keeping doubloons, ingots, used Rolexes, and dental fillings you’ve stolen from dead people in the fireproof safe under the stairs in the basement, would be a wise investment decision. Right?

At least Glenn Beck thinks so. Sure gold is a really well known precious metal that’s used in many of the things rich people can afford to buy (jewelry, Monster cables, exotic food and alcohol, Bentleys) and it sure as hell is pretty to look at, but did you know that the human body can’t properly process or digest gold, not even during times of economic hardship? Gold also has been observed to flat-out lose its market value when the world gets plunged into fiery Armageddon and the first things to get burned down are the banks and stock exchanges. Certainly not “Rapture-proof”.

You cannot play videos or listen to music or surf the web or be entertained in any way by gold, and unlike a good deal of the marketing presentations from GoldLine, investing in physical gold has never earned any significant amount of money over the course of the investment for the buyer, rendering it a pretty useless strategy to diversify your wealth with.

Good investments, like real estate or stock dividends or bonds or equities or selling people a totally useless investment, help the buyer generate steady income for their portfolio and “put the money to work” for them, hopefully leaving you with a significant return that you can laugh all the way to the bank with. Gold doesn’t do any of these “wealth building” things, and in very troubled times there are better metal-based items that you could have spent your money on to ensure your survival.

Gold just kind of sits there.